Introduction

The era of making business decisions based on intuition is quickly fading away and nowadays business decisions are made after proper analysis of the existing facts and figures to come up with future predictive models.

Banks need to leverage on their massive data reserve for information generation and trends analysis

As far as Customer Insight is concerned the important metrics that need to be measured at a high level include:

- Revenue: Revenue needs to be tracked across different lines of business and channels. All revenue streams should be closely monitored

- Sales: This refers to the new sales that have happened across multiple products, customer segments, geographies etc. More the sales, higher the propensity for revenue generation.

- Acquisition/Attrition: This metric refers to the number of customers that the bank has acquired and the number of customers the bank has lost.

- Delinquency: It is very important to measure delinquency by customer/customer segment to ensure that it is only good customers that are being on boarded by the bank.

- Cross Sell: Through these set of metrics, the bank would be able to analyzed and determine how effectively the bank is able to cross sell products to the existing set of customers to generate additional revenue from them.

- Profitability: Profitability at customer, product level and also profit distribution across various geographies can be tracked via a BI solution.

It is with this in mind that SimAnalytics was designed.

Simba BI-SimAnalytics

Simscore allows banks management to make critical and timely decisions by viewing real-time dashboard showing performance of each of the Key performance area in regards to Branch, Product (penetration), regional analysis, industry and period achieved through Robust SimScore ETL engine to support:

- online analytical processing

- data mining

- process mining

- complex event processing

- business performance management

- benchmarking

- text mining

- Predictive and prescriptive analytics.

System understands business drivers, Trends and Risks on real time basis to help make

- Make Informed, facts driven decisions

- Improve Accountability

- Operational efficiency.

- Spend less time preparing reports and and more time on acting on analysis

Features of SimAnalytics

- Ease of Use and accessibility.

- Interactive dashboards – provide a comparative view of customer insight, transaction and operations, etc.

- Modern Look and feel.

- Robust ETL process-Efficient and speedy data mining process.

- Email Facility-ability to email a dashboard to the business user on the fly.

- More Information with Less Navigation through pages

- Highly scalable.

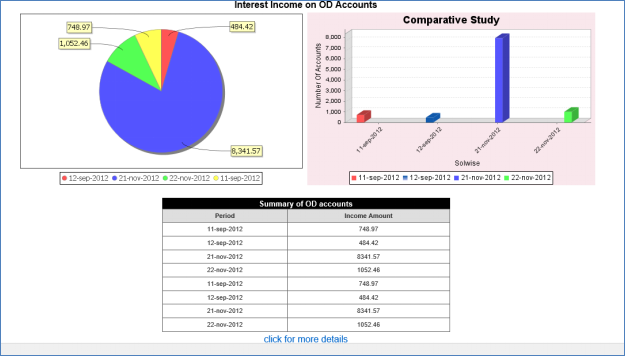

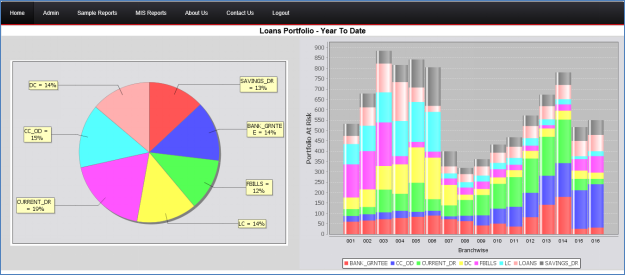

Sample Dashboards

The following diagrams shows some of the dashboards tracking performance indicators of interest in banking domain.